In recent weeks I have become aware of a disorder that has been hiding in plain sight. It afflicts thousands of people in the United States and elsewhere. You know most of the afflicted - they are on the covers of magazines, featured in documentaries, and some may own your favorite sports teams. And, like many disorders, our society, our laws, and our culture enable it - even encourage it.

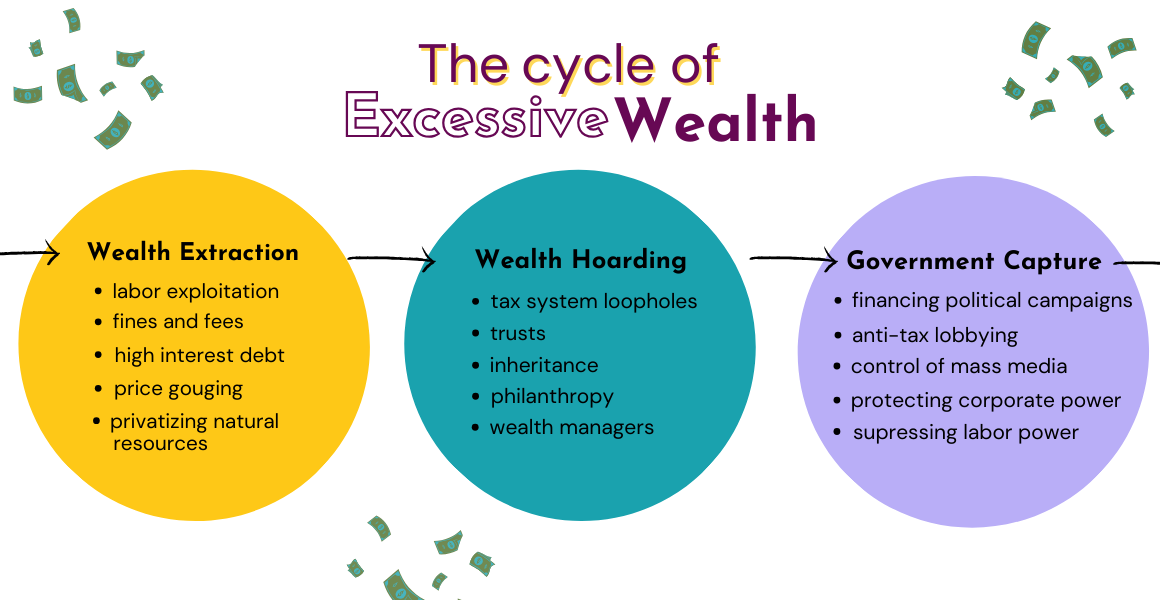

It's called Excessive Wealth Disorder (EWD), and it’s running rampant. According to the Excessive Wealth Disorder Institute, EWD is “a societal sickness resulting in the insatiable need to acquire more.” According to the Institute, EWD is a systemic issue and they have identified a cycle of excessive wealth that works effectively in the US (see below).

As a reader of Who Gives?, some of what you see in the diagram above will be familiar. Why? Because our high net worth philanthropic system plays a central role in enabling EWD.

Private foundations, donor advised funds, and other trusts play a critical role in reducing the tax burden of people with EWD. In fact, taxes and government are key targets for people overwhelmed by EWD, because they are the primary mechanisms capable of offsetting the corrosive nature of the disorder. And, people with EWD use charitable accounts to siphon away tax dollars that could be used to advance the American social safety net.

Charitable instruments should be used to offset this disorder rather than feed it. Unfortunately, people afflicted with EWD continue to hoard wealth in the management of their foundation balance sheets. Often investment committees across the foundation sector seek dangerous and toxic opportunities to grow or hoard more assets in their accounts. Many seek exorbitant returns on their assets by purchasing stocks in companies that inflate the prices of groceries purchased by everyday Americans. Others invest in real estate schemes that price lower income Americans out of the housing market or, worse, force people out of their homes through evictions. EWD can corrupt even the most altruistic among us.

Fortunately, there are ways to resist EWD in the philanthropic sector. At the Stupski Foundation, we are testing practices that break the fake rules designed to enable EWD. Here are a few examples:

Divest from profit-making activities - Foundations and DAFs are charitable instruments, not hedge, mutual, or venture funds. Yet, we pay hundreds of thousands of dollars to advisors who seek to make as much money as possible. The fake rule of “making money to give money,” inflicts more harm than good.

Fearful that any of these for-profit schemes could do harm to the very communities we seek to support, we have divested from all for-profit activities. And, we’re not alone. Divestment leaders in philanthropy continue to demonstrate how this can and should be done.

In our opinion, it is not the job of a foundation to grow and hoard assets, it is to return them to the communities from where they were extracted. Such an action upends EWD.

Build a board and investment committee of philanthropic professionals and community leaders vs financial professionals - Most foundations, typically governed by the original donor or their family, recruit financial and legal advisors to join their board. This was the case at Stupski for many years. These individuals usually either serve on, or lead, the foundation’s investment committee. Donors expect these individuals to grow their foundation’s assets.

To break the fake rule of hoarding through investing, foundations typically need to recruit board members that come from the communities they support and/or serve as program professionals at foundations. We took this action at Stupski and everyone that joined understood immediately that the foundation’s purpose is to advance our mission, not grow our assets. The new investment committee moved quickly to increase mission related investing and full divestment from potentially harmful investments.

Resist perpetuity - Finally, the overwhelming majority of DAF holders and, especially, private foundations believe they should exist forever. This dominating fake rule is a product of, and critical driver for, EWD. While the law states that foundations must move a minimum of 5% of their assets annually, most funders see the percentage as a maximum. Conveniently, maximizing one’s giving at 5% enables the sufferer of EWD from having to give their wealth away.

At Stupski, our founder made the decision that our ability to achieve maximum impact requires us to give it all away. Spend it down and shut it down. Her ability to buck the EWD and dedicate her charitable assets to charity put her in a much healthier place and benefited all of us who worked with her.

Excessive wealth is corroding many aspects of our social and economic sectors. We can all play a role in resisting it. Join us in upending the fake rules of EWD and do all you can to end any enabling behaviors in your life, especially if you work, and believe in, the potential of our philanthropic system. #BreakFakeRules

I have been in the philanthropy business for over two decades, and have had the opportunity to learn from hundreds of donors and other leaders.

At the top of my list of dynamic and innovative donors is Rachel Pritzker.

For several years now, Rachel has done an amazing job of funding spaces that intentionally break the fake rule of working in our ideological silos. After working in as a pioneering funder in climate and party politics, she came to the realization that only coalitions get anything done. She challenged herself, and many of us who know her, to step outside of our partisan and ideological silos to get things done.

She broke one of the most critical fake rules of our time!

Take a listen to the latest Break Fake Rules to learn more from Rachel.

Watch the abbreviated version of our discussion on YouTube or listen to our full exchange wherever you get your podcasts.

And, if you have a moment, share what you learned from Rachel and/or any thoughts that are coming up for you. We would love to hear what you are thinking about Breaking Fake Rules!

brilliant